Introduction

In the last blog of this series, we walked you through the things you should pay attention to while building the side of your bank’s transformation flywheel that delivers business value, and that means it’s time for the customer side of things. After that, we can focus on uniting the two to drive cyclical, continuous value for your bank — the real goal of any banking flywheel.

But for now, let’s take a look at the customer-related considerations of your flywheel, particularly where you should start. Here’s a hint: it’s all about fixing your bank’s customer journeys — the ultimate point of user friction.

The problem with fragmented customer journeys

Look, we’re all well aware that customer journeys in banking are fundamentally broken. Due to legacy tech and inside-out operating models, banks have inadvertently created a situation where customers have to wade through multiple fragmented channels to get a comprehensive look at their financial health, and that’s only the beginning of the problem.

At every stage of the customer lifecycle, and across all touchpoints, customers are overwhelmed with disparate interfaces and channels — and underwhelmed with personalization and user experiences. That means that, for many customers, every daily banking journey is an exercise in not only futility, but also aggravation. And your bank simply can’t afford this.

Did you know that

80% of customers say the user experience is just as important as a company’s products and services, according to Salesforce.

Just think of the effort involved to get help with a transaction dispute, for example. Many customers are forced to either call their bank or stand in long queues in order to resolve even the simplest of issues. And the digital side of things often isn’t much better. Constantly re-entering information the bank already has access to greatly reduces confidence and boosts annoyance, as does the process of dealing with nonfunctional chatbots and other digital “innovations.” And when your customers’ only barrier from jumping ship is the laborious process of doing so, it becomes clear that banks are in crisis mode.

It’s become clear that customers are no longer satisfied with the way traditional banks are conducting their business. But luckily, there’s a way to turn things around, and it starts with your business flywheel.

Using your flywheel to deliver customer value

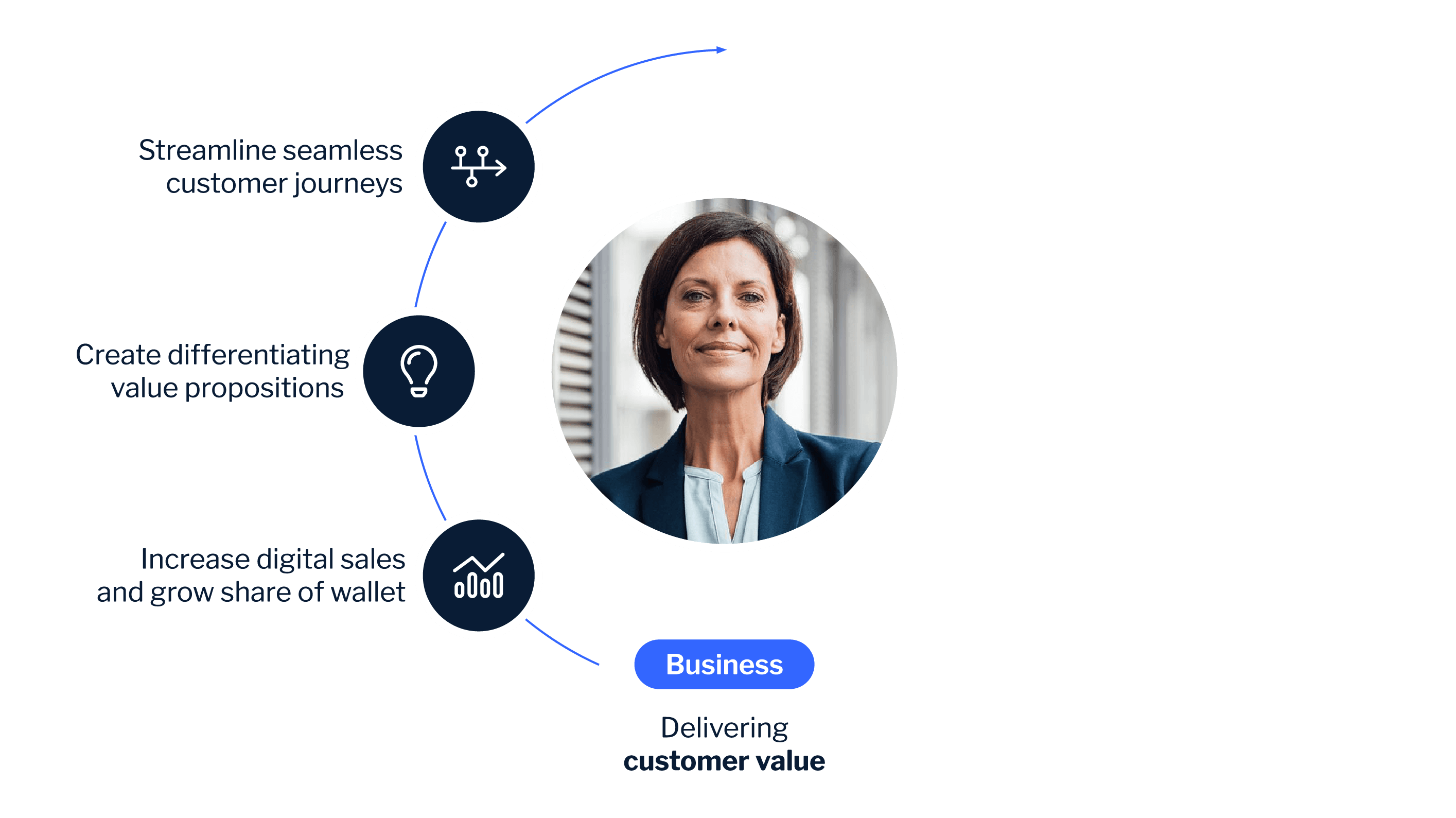

As we’ve mentioned, the customer experience is a major point of friction, but the silver lining here is that this also makes it an excellent entry point for your bank’s business flywheel, as shown in the chart below.

As you can see, delivering customer value can be as simple as:

- Streamlining your customer journeys — Start by streamlining the user experience to the point that you can offer ten-times-better customer journeys.

- Creating differentiating value propositions — If you can pull that off, you’ll have more funds for differentiation, an essential thing in the crowded financial sector.

- Increasing digital sales/growing share of wallet — Finally, you’ll realize the benefits with increased digital sales and greater share of wallet, which you can reinvest in further journey optimization.

If you need something to aim for, think of companies like Apple or digital banking challengers like Revolut, who have made a name for themselves with their brutal focus on removing any friction in their journeys and continuously optimizing their experiences. Of course, that’s easier said than done, but it’s a solid place to start. If you can pull it off, you’ll notice that you’re simultaneously simplifying your value propositions while increasing your conversion ratios and margins, eventually resulting in a winning formula that can basically self-finance itself.

By focusing on customer-centricity — which should be your goal, in and of itself — you’ll give significant momentum to your business flywheel and generate cost savings for the next round of optimizations. Then, you can start down new journey paths, like onboarding, cross-sell and up-sell, etc., and do so in a simplified way with a platform in the middle to orchestrate it. And you’d be amazed at the impact this can have.

Uniting your bank’s transformation flywheels

Now that we’ve explored the unique things you should be paying attention to while building your flywheels, we can finally discuss how to bring the two together. Traditionally, banks have thought of these as two distinct areas with their own attributes and considerations, but to create continuous value, you’ll need to unite the two, and in the next blog, we’ll tell you how to get started.

For more information, check out our Banking Reinvented podcast, where Backbase Founder/CEO Jouk Pleiter dissects similar topics alongside Tim Rutten, EVP/Chief of Staff, and other digital leaders. Stay tuned as they chat about everything from progressive modernization to decomposing your bank’s complexity.