Introduction

We’re sure you’ve heard about legacy tech, but have you heard of legacy operating models?

Over the last few blogs in this series, we’ve laid out all the reasons your bank needs to modernize its tech infrastructure and demonstrated how you can get there with a progressive approach. But now, it’s important to discuss something even more fundamental to your bank: its operating model.

Believe it or not, it’s not just your technology that’s holding you back, it’s also the way your bank is set up, down to its very foundations. That means it will be a massive endeavor to turn things around, but few things could be as important. Let’s take a look at the “story so far” and then discuss the best path forward.

The traditional operating model

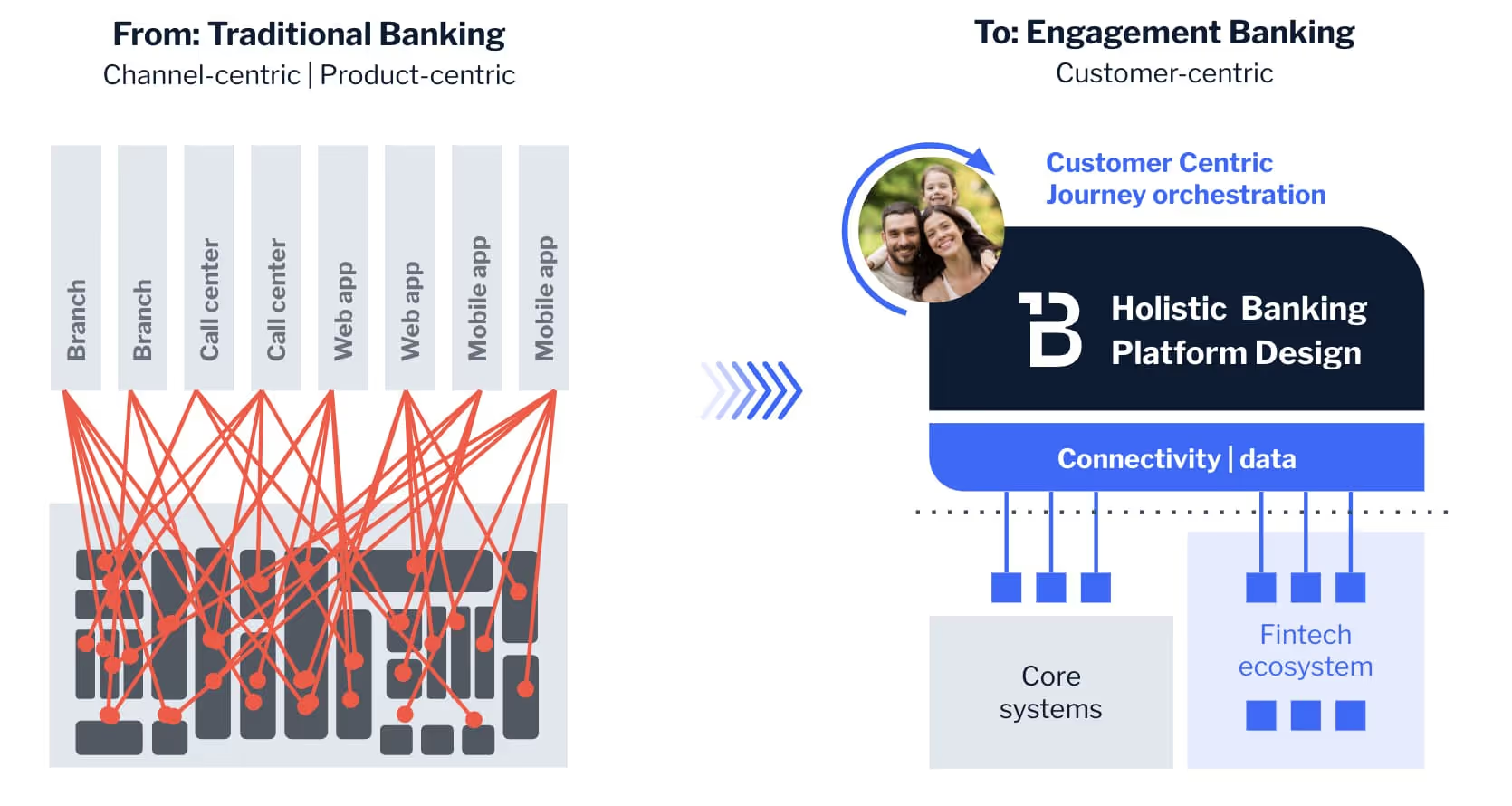

In the past, banks organized themselves in an incredibly inside-out way. Everything radiated from the core, where the product was defined and then distributed through the front, mid, and back office. The key word here is “push,” as banks pushed their products and services through these channels, then pushed them towards the customer, with little or no consideration of their wants and needs, as you can see in the chart below.

Customers were then forced to use these services, because what was their alternative? With most banks aligned on this channel-centric, product-focused operating model, there was little room for innovation or differentiation.

Naturally, looking at things through this inside-out lens came to define banks and their offerings. Every investment was targeted to either the front, back, or mid office, meaning this paradigm clearly dictated how banks were organized and how they operated, as well as how they secured funding. And, as you might expect, this model worked for a while, but it definitely doesn’t anymore.

Before we move on, let’s make something clear — you’re not at fault for the way things are. Many bankers are feeling the same pains, and most of them are struggling to find a way out. You’re all just playing with the cards you’ve been dealt, and we know it’s far from a comfortable situation. Luckily, there’s a way, and it’s all about customer-centricity.

The customer-centric operating model

Once again, let’s return to those paragons of customer-centricity: Netflix, Uber, and Apple. They don’t operate around the front/mid/back office, far from it. Instead, they take an outside-in approach — looking at what the customer wants and needs, then reverse engineering it to orchestrate relevant journeys and deliver consistent value. It’s clear that these companies aren’t using a push model, they’re using a pull model, and look at the success it’s brought them.

So ask yourself this — how visible to the customer are your bank’s investments in front-, mid-, and back-office channels? Probably not very. And if it’s not visible, it’s very unlikely that these investments contribute to differentiation. In fact, it’s more likely they’re continuing the trend of throwing money at siloed systems and legacy tech, making matters worse for you, day by day. We call that a negative spend cycle, and it’s every bank’s worst nightmare.

Now imagine if your bank could operate like a tech company, prioritizing its customer journeys and directing your budget that way. By focusing on what your customers actually want — rather than the inside-out approach that works best for your bank — you’d be able to create differentiating value propositions, the kind that allow you to capture market share, optimize your margins, and increase top-line growth.

And you’re sure to notice the difference fast, even if you use only 5% of the budget from that negative spend cycle. In fact, according to McKinsey, prioritizing the customer experience will enable you to realize a 20% improvement in customer satisfaction, a 15% increase in sales conversions, a 30% lower cost to serve, and even a 30% increase in employee engagement — and all while giving customers exactly what they’re asking for.

3 approaches for building a future-proof bank

Next time, we’ll explore how your bank can actually pull off its progressive modernization journey, including 3 key approaches: segment-based, journey-based, and headless. In the next blog, we’ll provide an intro to these three methods before we deep-dive into each of them, in turn, in the follow-ups.

For more information, check out our Banking Reinvented podcast, where Backbase Founder/CEO Jouk Pleiter dissects similar topics alongside Tim Rutten, EVP/Chief of Staff, and other digital leaders. Stay tuned as they chat about everything from progressive modernization to decomposing your bank’s complexity.