Backbase

Backbase-Powered Mobile Banking App Drives Member Adoption and Satisfaction for WSECU

Leading Washington State credit union increases registered mobile users by 39% after tapping Engagement Banking technology.

Washington State Employees Credit Union (WSECU), a leading Washington State financial institution, announced today the results of its ongoing partnership with digital banking technology provider Backbase as part of its modernization strategy. WSECU reports that, since launching its Backbase-powered mobile banking app in December 2019, registered mobile users have increased by 39%, and monthly active users have grown by 19%.

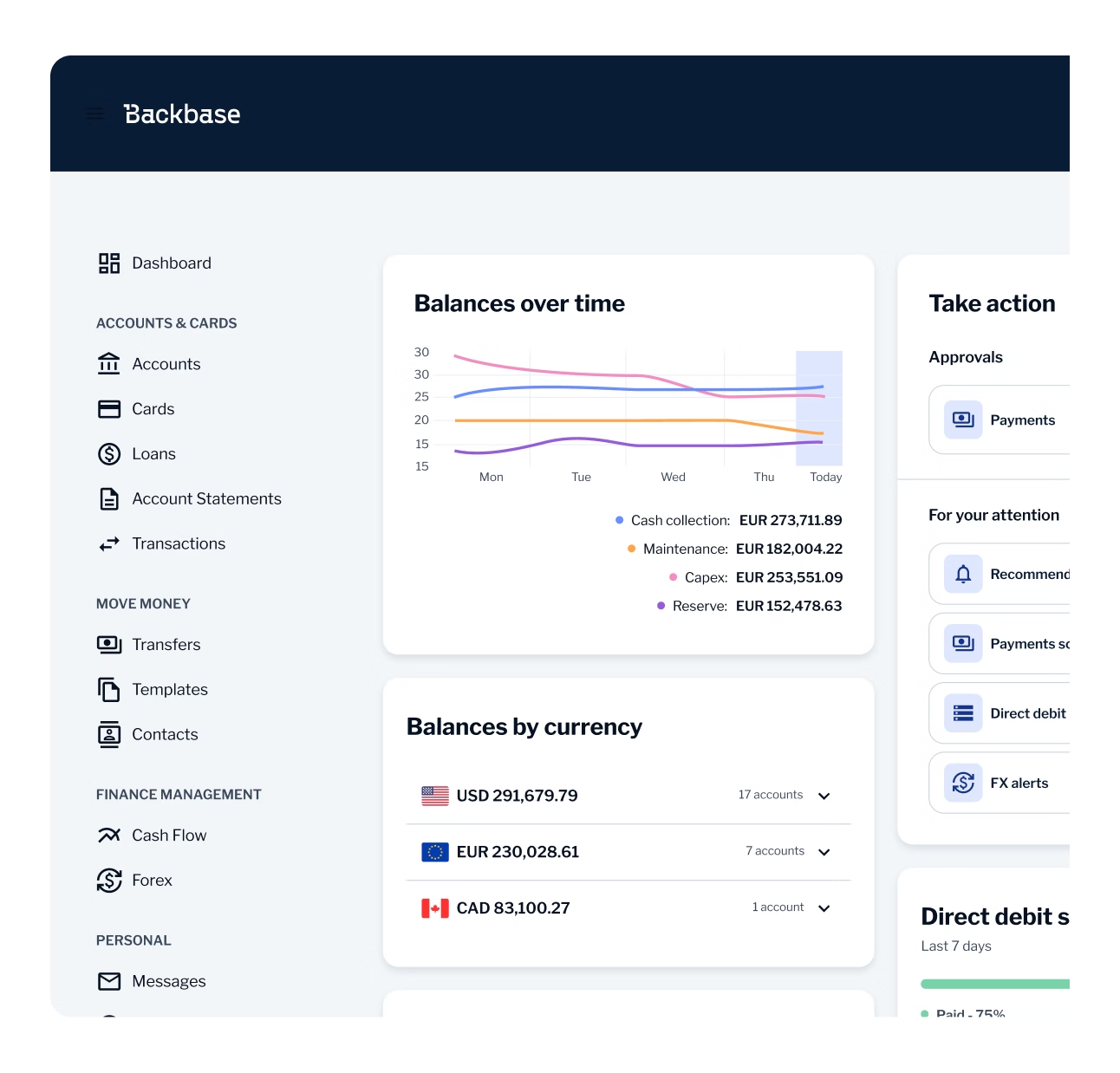

The enhanced app, built on Backbase’s Engagement Banking platform, has harmonized WSECU’s mobile banking experience with its overall online banking infrastructure, providing enhanced user friendliness and functionality for WSECU members. In addition, Backbase’s platform provides a strong foundation upon which WSECU can build to develop and deploy new technologies and offerings for its members on a continuous basis.

Core to WSECU’s digital banking strategy is completely owning the member banking journey from end-to-end, delivering a streamlined, secure omnichannel experience that evolves to meet shifting member demands. The new app has helped achieve this goal by ensuring consistent functionality across all of WSECU’s platforms – whereby all services available on the web are available on the app, creating a universal banking platform across all touchpoints and an improved member experience.

The out-of-the-box features and flexibility of Backbase’s Engagement Banking technology have proven essential to WSECU’s success over the past year, particularly amid the Covid-19 pandemic. Backbase’s platform allowed WSECU to quickly roll out app updates to address urgent member needs in the early days of the pandemic such as new self-service options for actions like loan payment deferrals.

Additional features available in the mobile app include member-to-member payment capabilities, new self-service functions, streamlined customer usability and additional multi-factor authentication options to heighten account security for members.

The past year has demonstrated more clearly than ever before the importance of speed and flexibility in our digital strategy. Not only has Backbase helped us develop and deploy the modern mobile banking app our members deserve; they have also helped us quickly adapt to the challenging circumstances created by the pandemic, ensuring that we can be there to support our members’ financial needs no matter what. The ability to continuously innovate and iterate upon our mobile app via Backbase’s platform has been invaluable.

Jim Averna

VP of Digital Services & Contact Center at WSECU

Vincent Bezemer, Senior Vice President, Americas at Backbase, adds:

“WSECU’s mission is deeply rooted in being a trusted, reliable community resource to its members, and delivering on that promise means creating a cohesive, intuitive digital banking experience. We’re pleased to have been able to support WSECU’s efforts in this area, significantly growing their members’ mobile engagement, and look forward to being a long-term partner to them in innovation.”

About WSECU

WSECU is a not-for-profit credit union open to all Washington residents with a special emphasis on serving those who embrace the values of giving, sharing and supporting their communities. WSECU has 270,000 members, 21 branches, and $3 billion in assets. It commits 4 percent of its annual net income to invest back into the communities it serves through partnerships with education and other nonprofit institutions.

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.